I was on the phone with an executive from a mid-sized firm last month, and she was sharing that their growth agenda for the upcoming year was biased toward low risk, “because they lacked the critical mass” to take on a potentially more rewarding project. I share this not because it’s not a good reason to be conservative, but because her firm was in a new stage, and her assessment was based on an old story.

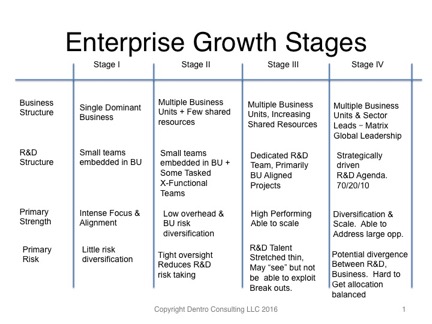

I use a four-stage model of organizations (see chart at the left – click to enlarge), and with some diagnostic questions, I am able to place a firm in the early, middle or late stages of each zone. There are two very dramatic steps in this chart: the II/III step and the move from stage III to stage IV.

What my client couldn’t see was that a more robust agenda was within her grasp because she was in the II/III transition. The stage II firm has usually gotten there through a combination of some shrewd m&a to set up several parallel businesses along with a very thin corporate layer. Think of this like a large ship where there is a top deck, but really closed compartments between operations. These closed partitions keep the ship afloat if one compartment takes on water, and in business the same thing is true.

Applying the analogy, in business this assumes that all opportunities across the business have the same rewards and leverage. This is rarely true, however can be a commonly held belief if enterprises have evolved by building themselves up in a compartmentalized way. When it comes time to allocate the growth resources, they are carefully apportioned by Business Unit (BU), and programs are operated independently. In this way, risk is managed by the BU General Manager (GM) and is compartmentalized.

The emergent corporate leadership needs to get comfortable with differential investment, where in fact one business contributes more that it receives (in the short term) for the good of the enterprise. The good news is that you don’t have to take this leap in one big step as we’ll discuss in moment. Trust and outcome can be built in layers.

In a stage III firm, they have established a dedicated R&D team that takes on projects on behalf of the enterprise. You can see that this ups the ante considerably, since the corporate team needs to provide an allocation to the R&D team, which is seen as a “tax” on their P&L, and the functional leads in the BU see it as resources that could be put to better use on operations improvements or product launches into the core. The benefit to the firm is that it’s able to take on higher ROI programs on behalf of multiple BU’s, and on a time scale that is not directly constrained by the BU product programs. A secondary benefit is that the full leadership team (CEO, CTO, BU GM’s, Sales Team VP’s) all have to get on the same agenda, and are able to deliver much stronger new offerings than any individual BU could deliver on their own. Lastly, in these talent constrained times, having a cross BU R&D function allows leverage of the best resources to the highest impact projects.

Late stage II firms have leaders embedded in the BU’s that intuitively know all of the stage III benefits above, but most commonly, the BU VP’s are reluctant to invest in a central R&D team. The corporate leadership can capitalize on the insight of their high value functional leads by building some cross-functional teams that can morph into an R&D team as the paybacks begin to become obvious.

Specifically a good stage II/III transition plan includes the following:

- Task the CFO with pulling together the full investment agenda for the top programs in each BU, including market, technology and key developmental tasks.

- If you don’t have a CTO on board, contract with a good external resource to review the programs and do the investigation to develop the potential cross team programs.

- Have a good growth resource step back and develop an objective “strawman” cross team agenda, and also a larger agenda for the market including zone 2 and 3 (see the growth zone definitions here)

- Have a well-facilitated session that is focused on finding synergies that will drive the whole business to outperform the sum of its parts. This will involve pre-work, and pre-dialogues to set the stage for discussion using the monte carlo method. Depending on the level of cross-team cooperation, this may need to be done over an arc of a couple of sessions with detailed dialogue and homework between.

- Once established, work out the execution and governance of these projects. Usually this is best done with a joint mini “BOD” that is made up of select members of the sponsoring BU’s, and an operating group that is emerging r&d leaders.

If you are interested in developing a plan to take advantage of this strategy, I’d look forward to having a discussion of experiences and applications. For more on my engagement model, take a look at my services page here. As always, to reach me send me an email or call me at 847-651-1014.

Related posts you can benefit from…