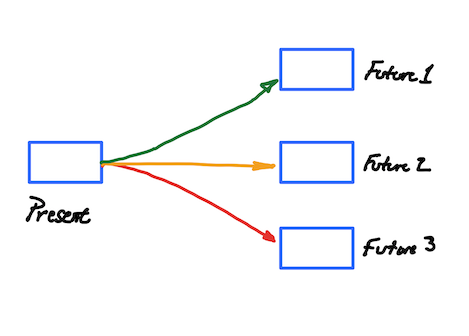

With 2022 right around the corner, many firms are having discussions and making decisions about which new products and services to pursue in the next year and beyond. These choices, and how they are deployed, will lock in one of these three futures:

- The red path is one of decline, where more effort and investment results in diminishing returns

- The amber path represents lateral movement with neither growth nor decline

- The green path is one of growth, with cumulative insights building on themselves to produce an extraordinary future

Beware the Amber Line

The truth is that the amber line, while seeming sustainable, is a myth.

When a firm has had a history of success and has built a buffer of financial resources, it’s very easy to back into a cycle of confirmation bias, that if we continue to do what used to work, we’ll start winning again. This leads to overhead becoming dominant and what we sometimes call the “accidental not-for-profit.”

When we drill into portfolios, we often find amber products and services that have been subsidized by the green line activities.

The Danger

Time spent on the Amber Line doesn’t come without consequences – there is a price to be paid. In fact, when we put our hope in lateral stability, we are setting ourselves up for decline.

Here’s a few of the most common issues I see:

- Teams that camp out on the Amber Line are exposed to market pressures from fresh innovators who will challenge the firm to continue to be effective in serving our clients. The longer we stay on the Amber Line, the more we start to serve our internal narrative, rather than the emergent needs of our clients.

- Due to the loss of ability to take the attitude of a learner, time spent on the Amber Line leaves teams and organizations with little to no options on how to “get back on track.” Time is our most valuable resource – it’s the one thing we simply cannot manufacture more of. When it’s invested in creating internal stability, it has the effect of anesthetizing us to real shifts in our client’s product and service needs.

- Finally, there are irrecoverable costs being incurred in budget, attention, and resources. Once spent on stability, they cannot be repurposed to learning and growth.

The bottom line? Staying on the amber line is a myth and is dangerous. We are either on the red line or the green line.

The Opportunity

What does it look like to snap onto a trajectory that puts us on a green line? In working with clients, I’ve noticed a pattern of three stages:

#1 Catalytic events

These can come from a variety of places. They might include board pressure, market disruption, or client defection. All are significant emotional events that can draw focused, sponsored actions.

A rich diagnostic process will lead to two understandings. The first is to clearly identify adjacent options for new products and services; the second is to answer which of the firm’s assets can give it a head start to thrive in the new space.

#2: Focus and Consolidation

This is where we get very specific on how we can address those new areas of growth and what assets we can redirect toward the fresh opportunity. Focus allows us to drill into the fresh part of the market and deeply understand the needs from their viewpoint. We develop a razor sharp profile and then decompose it into what we need internally and externally. The next step is to consolidate our assets in support of this new client brief and remove distractions and old assumptions from the mix.

#3: Reloading

This is a process we use that allows us to regularly step back and assess how we are addressing the highest leverage items. Rather than a traditional linear approach, we view it as a spiral of setting a plan, taking action, and assessing results.

By setting regular reviews to reprioritize, we take the best practices of the software world and apply them to the full product. By restacking the priorities we can move with surprising speed to bring forward new products and services. For more on this, check out the article here.

The Plan

Depending on how long the firm or line of business has been on the Amber Line, inertia will make it hard to escape this territory. To capitalize on the catalytic event and get on a sustainable green trajectory, you need a proven program to build a plan for accelerated evolution (see posts here, here and here).

Through my work with fortune-level firms, I’ve assembled a diagnostic path that will reveal precisely where to focus to move you out of the amber zone.

If you’ve read this far, you’ve likely had a nudge that you may have some amber zone activities that need some work.

Let’s start with 20 minutes where I’ll share my latest insights about how COVID is affecting products and services firms. If that sounds helpful, use this link to put a call on the books.

Related Posts…