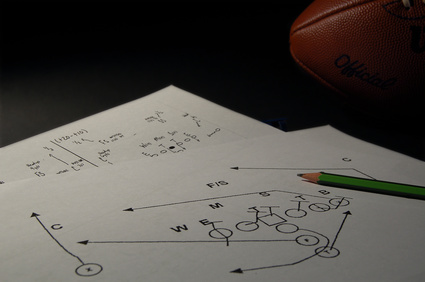

We see it in other places all the time: a football team has a great game plan, dominates through the middle of the third quarter, then moves to a “defensive” plan, where their focus shifts to protecting the ball and running down the clock. The predictable outcome is that the opponent stops the run, receives the ball and starts to take some chances that put the other team on its heels.

In business, this takes the form of the breakout company that has a breakthrough in a new product category, experiences some follow-up successes and then “monetizes its success.” This series of events usually coincides with the departure of the breakout leader who wants to “pursue other interests,” and the subsequent promotion of the lead operation’s person to their position.

Early on, the departure of the visionary leader who led the breakthrough creates the appearance of a small speed bump, and then a business as usual calm ensues. The interesting thing is that the macro financials will blossom in this scenario, as optimization of previous gains makes it appear that growth is still robust.

There is a big difference, however, between having been on the team that did the breakthrough work, and having sat in the “hot seat” and making the directional decisions for the breakthrough. The common issues that show themselves in this scenario are: decisions that were once made crisply are now caught up in cycles of analysis and justification, project schedules begin to stretch out and products start to escape the process with quality issues that would have been uncovered previously.

These issues will first eat away at margins, and then if not arrested, will threaten the viability of the business unit.

5 Costs That Arise From Losing Innovation Momentum

For today’s post, I want to focus on the hidden costs of going into a “stall offense” with your planning. These costs are a result of stagnicity in five key “soft” investment areas, all of which are critical for reigniting and embedding a culture of innovation.

#1: Customer Network

Innovative organizations know that their connection with innovative customers is key to their growth, as they push organizations to stay on the cutting edge. Sales and account talent who can foster these connections are very different than those who do account maintenance. The antidote for this is for senior leaders to make a very visible and authentic investment with these customers, sponsoring customer advisory sessions and deep dives that keep them close to their thought leaders.

What’s at stake: Once an organization falls off the innovation curve, top talent bleeds away and this advantage begins to erode.

2) Partner Network

On the other side of the business model, innovative organizations have the wherewithal to value and help their key downstream partners grow by sharing expertise in the form of market insight, customer trends, and technology direction & plans in return for the great content they bring. For services organizations, this may be a great back room “white label” suite of services, or for a manufacturer, a key material supplier.

What’s at stake: While these partners will continue to put resources in organizations that invest in them, they’ll quickly withdraw investments from those who get stagnant.

3) Decision-Making Skills

This is one of the hardest areas to replace in an organization once it has eroded. Since most organizations have a 36-48 month clock cycle on talented leaders changing positions, having bench strength to fill these key decision making slots, (product line managers, brand managers, platform leaders, solution architects, etc.) is incredibly important. One of the first diagnostics I do with large organizations is to go over their “HR Balance Sheet” of key innovation decision makers. Once the growth talent in a pipeline sees a paper jam ahead, they start to return those headhunter calls they have been ignoring.

What’s at stake: The ramifications of losing your skilled decision makers ripples through the organization as lost momentum. Crisp cadence and trajectory is the lifeblood of innovation, and like a band that loses a skillful conductor, the whole business unit can slow to a crawl.

4) Breakthrough Talent

It’s popular fiction that harmonious and well-structured interactions lead to breakthroughs. In fact, my experience is that this is very rare indeed. Most breakthroughs are led by a visionary and influential subject matter expert who both forms a very informed and precise opinion and is very effective in driving it forward. This usually takes the path that make some in the organization cringe – like speaking up at C-level town hall meetings with hard questions, pushing peers on their viewpoints assertively, and challenging management at every turn.

What’s at stake: One of the early signs of organizational decline to mediocrity is when conformity is valued above merit – and these very important influencers begin to exit.

5) Financial Resources

The investments an organization makes is the most fundamental statement of strategy – and a huge signal to the internal team of management’s true intentions. When funding decisions are dominated by the primary internal product line or the need for short-term earnings, very bad things begin to happen.

A great leadership team manages the tension between the short and long game, assuring the investors that their needs are cared for, while making the innovation investments that lead to eye-popping gains down the road. Specifically, the funding waterfall that a breakthrough brings needs to be skillfully invested in areas that will lead to learning and growth of similar breakthrough products and services.

What’s at stake: When hard won resources are consumed by low ROI enhancements in an existing product line – instead of skillfully invested – it stalls progress towards future innovation breakthroughs.

I would love to get your comments and feedback on what your experiences are in organizations that have chosen to play defensively after a period of robust growth.

Please drop me an email or put a call on our calendars using this link.

Related posts you can benefit from…